Minimum wage calculator after tax

This calculator can determine overtime wages as well as calculate the total earnings. Tax composition Summary After paying tax and ACC the amount of income from a 4160000.

Living Wage Calculator Living Wage Calculation For Philadelphia County Pennsylvania Dekalb Social Science Social Services

How Your Paycheck Works.

. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Texas. If you make 55000 a year living in the region of California USA you will be taxed 11676.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Federal. The average monthly net. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

With a standard working week lasting a tiring 38 hours the minimum wage is equal to a weekly salary of 77260. This places US on the 4th place out of 72 countries in the. That means that your net pay will be 43324 per year or 3610 per month.

But calculating your weekly take-home. Minimum Wage Salary After Tax. Using The Hourly Wage Tax Calculator.

On The Adult Minimum Wage annual salary you will pay 630000 PAYE tax and 60736 ACC. The money you take home after all taxes and contributions have been deducted. The money you take home after all taxes and contributions have been deducted.

Your employer withholds a 62 Social Security tax and a. United States US Salary After Tax Calculator. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. National Minimum Wage and Living Wage calculator for workers. That means that your net pay will be 43041 per year or 3587 per month.

This calculator can determine overtime wages as well as calculate the total earnings. You must be at least 23 years old. Your employer owes you past payments from the previous year because of underpayment.

The California Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and California State. Also known as Net Income. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table.

United States US Salary After Tax Calculator Minimum WageSalary After Tax. That works out to monthly earnings of just under 3350 or a yearly salary of. Your average tax rate is.

Hourly To Salary What Is My Annual Income

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Annual Income Calculator Sale Online 50 Off Www Ingeniovirtual Com

Free Paycheck Calculator Hourly Salary Usa Dremployee

Salary Formula Calculate Salary Calculator Excel Template

Annual Income Calculator Sale Online 50 Off Www Ingeniovirtual Com

Payroll Calculator Free Employee Payroll Template For Excel

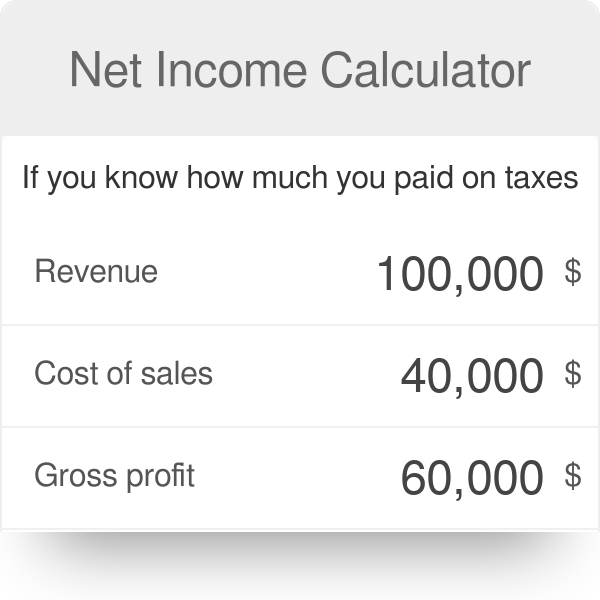

Net Income Calculator Find Out Your Company S Net Income

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate Wages 14 Steps With Pictures Wikihow

Annual Income Calculator Sale Online 50 Off Www Ingeniovirtual Com

How To Calculate Wages 14 Steps With Pictures Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Free Paycheck Calculator Hourly Salary Usa Dremployee

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Wages 14 Steps With Pictures Wikihow